ISSN : 2393-8854

Global Journal of Research and Review

A Financial Literate Woman Can breaks the Boundaries of Biasness through Better Understanding of Investment Decisions

Tahira Iram1* and Ahmad Raza Bilal2

1 Department of Commerce and Finance, Superior University, Lahore, Pakistan

2 Department of Business, University of Sohar, Oman, Pakistan

- *Corresponding Author:

- Tahira Iram

Department of Commerce and Finance,

Superior University,

Lahore,

Pakistan,

E-mail: mini_sayal1@yahoo.com

Received Date: March 30, 2021; Accepted Date: April 13, 2021;Published Date: April 20, 2021

Citation: Iram T, Bilal AZ (2021) A Financial Literate Woman can break the Boundaries of Biasness through Better Understanding of Investment Decisions. Glob J Res Rev Vol.8 No.S2:005 .

Abstract

Behavioral factors that compel people to engage in decision-making studies may help people make better investment decisions on a number of important decisions. Women entrepreneurs in emerging markets are often confronted with these issues and their investment decisions can be complicated. We argued that, in addition to heuristics and behavioral influences, women's financial literacy is an important factor in making rational decisions. We collected data from registered women entrepreneurs using a proportionate stratified sampling approach. The data analysis software SMART-PLS is used. The results showed that financial literacy plays an important role in mediating the relationship between heuristic behavioral factors and investment decisionmaking. Implications for financial practitioners’ and academicians’ understanding of financial literature's mediating role and the significance of age factors are discussed, which are missing elements in the existing literature.

Keywords

Heuristic; Financial literacy; Women entrepreneurs; Investment decision

Introduction

In recent decades investment has become much more difficult due to irrational behaviour (Salim and Khan). Many investors are extremely concerned about their investment decisions, as they believe that everyone expects to profit from their efforts [1,2]. Similarly, this has a wide range of advantages that have to do with the subtlety of financial investment [3]. In investment decisions affecting women's entrepreneurship, this phenomenon has become more appealing. In terms of economic growth and job creation, women's entrepreneurship has gained widespread attention [4-8]. According to various researchers, the economy has a significant effect on female entrepreneurs in Pakistan [9,10]. Without a doubt, female entrepreneurs lead to longterm development and poverty reduction [11,12]. Women entrepreneurs are particularly vulnerable during economic downturns. The economy has been put under strain as a result, forcing them to become self-sufficient through profitable business ventures [13]. When women discover a factor that motivates them to invest, they gain trust [14,15]. They are depicted as materialistic, but they are motivated by the expectation that financial results would be equally valuable in the future for their freedom [16].

Women's decision-making processes are undervalued, and they are not nearly as effective as entrepreneurs, which is especially difficult in developing countries where women have several responsibilities [16].Above all, Pakistani women may be limited by societal, familial, and religious obligations [17]. Aside from that, women face a slew of challenges when it comes to starting a company in a developing country like Pakistan. In our society, Pakistani culture restricts a woman's ability to run a successful company. Hasan also reveals the harsh realities in which women live [18]. Unfortunately, many women still face gender discrimination in Pakistan [19]. We see Pakistani women entrepreneurs facing various obstacles when choosing to become entrepreneurs (such as gender norms, history, family issues, etc.). [18]. A woman's investment decisions therefore need attention [20]. In comparison, Shah and Saurabh claims that female investors display irrational behaviour [21]. Human decisionmaking is not always optimal in behavioural finance [22].

Women entrepreneurs must be qualified to run business effectively in financial matters [23]. Financial literacy is a vital requirement to benefit from opportunities, growth and competition [24]. The lack of financial literacy for women in Pakistan is a problem, and there is no access to finance for women. Thus, a lack of financial literacy impedes entrepreneurial ideas and goods, thereby reducing business growth and capital gains [24,25]. After the economic crisis of the last decade, we have realized that unsophisticated financial individuals may cause significant damage if they can profit from others [26]. Cash flows, assets or liabilities have been raised or decreased [27]. Whatever else, women in Pakistan are under entrepreneurship due to lack of financial literacy, only 15% of women entrepreneurs are financially educated [9,28]. Research shows that women suffer as a result of gender disparity in investment choices [20]. It is quite possible that financial expertise and competence are needed for the paradoxical situation concerning rationality or irrationality in investment decisions. As the lack of experience and knowledge of personal finance has a detrimental impact on women searching or looking for a career, it is extremely important to make financial decisions while studying [29].

Alongside the other factors listed earlier, we advocate the role of financial literacy in investment decision making for women; we argue that financial literacy should deal with women's heuristic conduct. The study has a triple objective linked to entrepreneurship among women: financial literacy as a mediator between heuristic actions and investment decision-making. Secondly, the relevance of this study has also been illustrated in developed countries where women must be empowered financially. In addition, this research illustrated Pakistan's strong investment decisions.

Six portions of this study. Investment habits and a literature review are discussed in the second chapter. The third part of the paper presents the research results. The fourth section describes the methodology for research; the following section discusses results. The final chapter contains final discussions, research implications and limitations of the analysis.

Literature review and hypotheses development

Many studies discussed the effects of behavioral biases on investors' decision-making and examined the relationships between emotional and cognitive habits and financial literacy and performance. People see precisely what they want to see. Some of their results are quite relevant and beneficial for this current investigation.

Heuristic behavioral theory

By reducing complicated calculations and reducing unpredictable events, complex and difficult investment decisions are made more accessibly by heuristic thumb rule [30,31]. Follow the investment decisions of other researchers when time is not sufficient to calculate whether or not to invest [32]. Kahneman and Tversky addressed the most important forms of heuristics, however: anchoring, availability and representative [31]. Waweru et al. later introduced more components of heuristic trust in the three forms above [32]. In the article published by Shah, investors can use heuristics to avoid losses in non-deterministic scenarios [33]. Their self-knowledge and the technical understanding and reasoning they reached when they were influenced by investors often hinder judgment. Investors are behaving irrationally, leading to irrational decisions. These extra costs would affect the value of the company as follows:

Over confidence heuristic

Through the concept of overconfidence, the individual overestimates his skills, his experiments and precision of the information, and even the predictive abilities [34]. The behavior finance literature shows that there are many types of investing styles; investor decision-making has two ways to under-react tend to market information, and other is overreact tendency to market information [35]. Its means that investor shows optimistic behavior when the market goes up and show the pessimistic behavior when the market goes down, it represents the bullish and bearish trends prevailing in the market.

H1-Overconfidence bias has a significant impact on investment decision

Overconfidence and financial literacy

If the investor is overconfident, he shows that he is well in the financial calculation [36]. Overconfident investors seek less professional financial advice regarding investment, debt counseling, and tax planning [34]. A retrospective review of prior studies has shown overconfidence to be related to the allocation of investment capital and the preferences of investors, as well as the corresponding risks they are exposed to, and their capability to the understanding those risks [37]. H2-Overconfidence bias has a significant impact on financial literacy

Representativeness heuristic

Making choices is the most difficult part of entrepreneurship. This is because each person's cognitive approach or cognitive skills constantly push him or her to make decisions. Psychologists are more knowledgeable about the psychology of human behavior and the perception of possessing a kind judgmental attitude [38]. Heuristics are often guided by psychologists, based on their critical skills. Other than business decisions, heuristic skills are shortcuts for individuals in their daily lives. The essence of a shortcut varies depending on the individual. Every person has their own shortcuts, and the representativeness heuristic is one of the most popular shortcuts mentioned by Kahneman and Tversky in their article, according to which the individual who is representative of results is more reliant on evidence parts [39].

Representativeness and financial literacy

The majority of investment decisions are based on numeric or calculation-based data that depicts a particular event or the likelihood of that event occurring or not occurring [40]. For example, what are the chances of event A and event B, or how is event A affected by event B? [39]. An investor who lacks financial literacy would be unable to comprehend past numerical records. Individuals with strong financial skills have a low degree of representativeness bias [41].

H4-Representativeness heuristic has a significant impact on financial literacy

Anchoring heuristic

Anchoring bias is a widespread phenomenon that has an effect on all aspects of life [42]. The term "anchoring bias" was identified by researchers using various lenses. For example, Meub, Proeger, and Bizer argued that an investor's propensity to invest in the stock market based solely on any available information is anchored [43]. Wilczek, on the other hand, demonstrated the human herd bias tendency by stating that people are better at relative thought than absolute thinking, which is similar to the anchoring bias [44]. He demonstrated that people ignore new knowledge and make investment decisions based on what they already know or their own views. Anchoring bias was described by Din, Mehmood, et al. as a human propensity to make decisions solely based on the first piece of knowledge or evidence (anchor) [45]. Furthermore, Kannadhasan and Nandagopal accepted that people ignored current marketing trends and made decisions based on previous experience and outdated knowledge. Specifically, investors believe that obsolete knowledge or procedures will assist them in making better decisions. The focus of behavioral finance research has been on the irrationality of investors; however, more attention should be paid to the entrepreneurial and managerial perspectives.

H5-Anchoring bias has a significant impact on investment decision

Anchoring heuristic and financial literacy

The anchoring effects are influenced by informational significance and financial experience, according to a study [46]. Englich, Mussweiler, and Strack have suggested that irrelevant data may have a variety of effects on an expert's decision-making [47]. Investors with previous transactional experience can forecast the outcome, but his ability to invest could be influenced by anchoring bias [48]. Owners with financial and prevalent awareness may be more concentrated on minimizing their float to speedy cash accumulation, thus minimizing anchoring bias, according to [49]. They believed that owners who have knowledge of market dynamics, the economy, and inflation control their cash by anticipating anchoring biases. Higher financial awareness and experience, according to the claim, reduce the anchoring impact [50]. It means that as one's financial literacy level rises, so does one's proclivity for anchor bias. Surprisingly, Abreu and Mendes discovered that females have low financial literacy and thus face the anchoring bias, but further research is required to fully understand this relationship [51]. As a result, the researcher looked into the connection between financial literacy and anchoring bias in women entrepreneurs. As a consequence, the following hypothesis is proposed:

H6: Anchoring bias. has a significant association with financial literacy

Availability heuristic

Availability characterizes as a dependable guideline, which permits individuals to figure out the opportunity of a result dependent on how predominant or educated that shows up in their lives [52]. In the association, availability heuristics consider useful for the dynamic moral procedure or the advancement of the ethic [53]. In the money-related dynamic financial specialist response in the present of availability heuristics as a redesign or downsize. Kliger and Kudryavtsev argued that if the stock value goes positively up with the positive financial exchange then return is more grounded [54]. In Pakistan, the investor likes to invest in those plans which are readily available; they usually rely on the information from family friends, etc. thus, in Pakistan, availability bias plays a vital role in investment decisions [55].

H7-Availability bias has a significant impact on investment decision

Availability heuristic and financial literacy

Individuals without financial literacy, according to Barber and Odean, could not manage the massive amount of details needed to choose safeguards or stocks [56]. An person is reliant on the data that is available, which is often not intellectually accessible. To avoid cognitive biases and make reasonable decisions, a person must have proper financial knowledge to ensure reliability and access to data.

H8-Availability has a significant impact on financial literacy

Financial literacy as a mediator

A person's ability to manage financial matters can be hampered if cognitive ability deteriorates. In the presence of financial literacy, investment choices are more rational and realistic [57]. Investors like to show interest in risky decisions and through financial literacy, positive investing habits enhances investment decisions dramatically [58]. Investors who are financially savvy and willing are more likely to invest in stocks [59]. According to Ahmad and Shah (2020), behavioral biases can lead to irrational investment decisions, and financial literacy can help investors make better decisions [33]. Owing to a lack of financial knowledge, investors often make unreasonable decisions.

H9-Financial literacy mediates between overconfidence and investment decisions.

Scholars have established that financial literacy is a global issue [34]. Bad financial conduct can have fatal implications at both the individual and global economic levels (Klapper and Lusardi). When it comes to money or finance management, an individual is presumed to have a financial attitude on a personal level. When it comes to investment decisions, women entrepreneurs are more likely to be biased than men, but high financial literacy decreases this bias. Since the representativeness heuristic often relies on previously collected data, it is critical to be financially literate in order to comprehend the data and make sound investment decisions [60].

H10-Financial literacy mediates between Representativeness and investment decisions

It is argued that such cognitive operations generate the need for financial literacy, and that having financial literacy would allow one to make sound investment decisions. As a result, financial literacy can be a good way to move mental anchoring in order to make sound investment decisions. We hypothesize that anchoring has a major effect on investor investment behavior, and that men anchoring bias is more prevalent in women, based on these claims [61,62]. The investor's conduct changes as a result of financial literacy, and he uses it to make sound decisions [29,63]. By presenting relevant financial information and expertise, financial decisions can be strengthened, and cognitive bias, such as anchoring, can be reduced [64].

H11: financiial literacy mediates between anchoring and investment decisions

As previously stated, availability is a mental state that depicts shortcuts based on previously available information, and awareness of this mental state may encourage a person to share information or improve their communication skills with others. As previously stated, financial literacy is considered a skill, and lacking this skill can lead to poor investment decisions [57]. Since the availability heuristic often relies on unfamiliar information, it is critical to be financially literate in order to properly rely on that information and make sound investment decisions [14,60].

H12: Financial literacy mediates the relationship between availability and investment decisions

Financial literacy

Previous research has discovered several contradictions when it comes to describing financial literacy [29]. Others (e.g., Lusardi and Mitchell) describe financial literacy as "understanding basic financial principles and the ability to perform basic calculations [65]." Huston (2010) also looked at how well people understood personal finance and how they put the information to use. Despite its paradoxical prevalence, financial literacy has gained widespread recognition as a necessary life skill for improving economic well-being (OECD, 2017) [66]. Since financial literacy increases the perception of financial risks and opportunities, it can help people make better financial decisions [67]. A financially literate person is aware of market risk and can make informed investment decisions based on their risk tolerance [68].

Also financial literacy promotes sound investment decisions, which increases business efficiency [57]. A more knowledgeable person will be better able to make well-informed investment decisions and remain updated on financial markets [69]. Without a question, investment decision-making tends to be a complicated process that is influenced by a variety of factors such as personality, gender, socioeconomic context, perceptions, beliefs, and other demographics [20].

Investment decision

This investment decision is often affected by the investor's analysis of market data in order to take a risky investment decision. Investors that are new to the market make irrational decisions all of the time [70]. Since the investor is afraid of losing money, it doesn't matter how much he studies the market or how much knowledge he gathers from it [71]. According to traditional financial theory, rational investors are those whose investment decisions are based on rules of thumb that help them optimize their capital [70]. Investors who lack proper financial literacy make irrational investment decisions [57]. Market knowledge, financial literacy, individuals' risk-taking capacities, and account-related information are all factors that influence investment decisions. The investor's action has a big impact on his or her decision, and most people act irrationally and inefficiently in the market [72].

Financial literacy and investment decision

Arguing on financial literacy, Atkinson and Messy have asserted that awareness of necessary finance will be useless without it being mirrored in financial behaviour [73]. Financial awareness, it is debatable if it is responsible for causing action to make a successful investment. Individuals with a high level of financial literacy have two thought styles (cognition and intuition, for example) that affect their financial decision-making process [74]. Since financial literacy increases the perception of financial risks and opportunities, it can help people make better financial decisions [73]. A financially literate person is aware of market risk and can make informed investment decisions based on their risk tolerance [68].

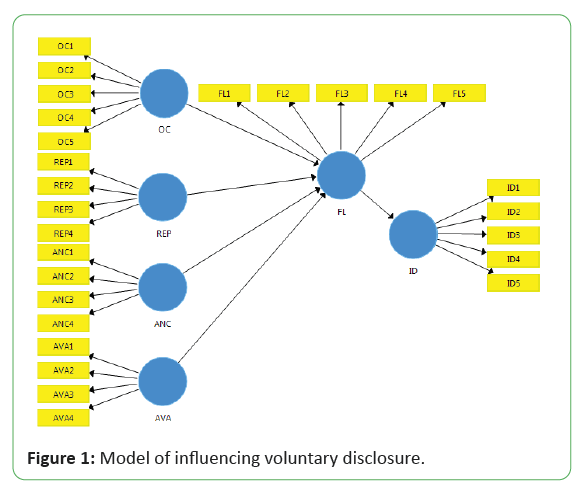

Also financial literacy promotes sound investment decisions, which increases business efficiency [57]. A more knowledgeable person will be better able to make well-informed investment decisions and remain updated on financial markets [58,69]. Without a question, investment decision-making tends to be a complicated process that is influenced by a variety of factors such as personality, gender, socioeconomic context, perceptions, beliefs, and other demographics [20]. As a result, getting financial literacy can have a huge effect on how you make investment decisions. We assume that, based on the above arguments (Figure 1).

Figure 1: Model of influencing voluntary disclosure.

H13: Financial literacy is significantly associated with investment decision

Materials and Methods

The population in this study is women who are registered as entrepreneurs in Punjab, Pakistan. An online questionnaire was used to collect data from the women's chamber of commerce in Punjab, Pakistan. The Proportionate Stratified Sampling method, which is used to collect the data, examines the different facets of the population and reflects the sample's accurate representation. The population is divided into two strata for proportionate stratified sampling based on two women chambers of commerce operating in Faisalabad and Multan, Pakistan, namely Multan women chamber of commerce and Faisalabad women chamber of commerce. The sample size formula Ruane is used [75]. If the population is less than 500, consider 50 percent of the total population as a study, according to [76]. The sample size for this analysis will be greater than the minimum threshold set by the NIH [76]. The overall sample size is calculated according to Ruane for an accurate representation of the population [76]. In this study, data was collected through an online questionnaire. It is made up of two pieces. The demographic characteristics of women entrepreneurs, including their age, are addressed in the first segment of the survey. Overconfidence, representativeness, anchoring, affordability, financial literacy, and investment decisions are all discussed in the second section [77-100]..

Questionnaire is emailed to the 210 registered entrepreneurs and responses were received from 99 entrepreneurs only. Samples are derived in a proportion of total population in two chambers of Punjab, can be seen in above (Table 1).

| Punjab stratum | Women entrepreneurs | Proportionate stratified sample | ||

|---|---|---|---|---|

| Frequency | %age | Frequency | %age | |

| FSD CC | 103 | 50% | 51 | 50% |

| Multan CC | 283 | 50% | 142 | 50% |

| Total | 303 | 50% | 193 | 50% |

Table 1: Proportionate stratified sampling.

Measurement

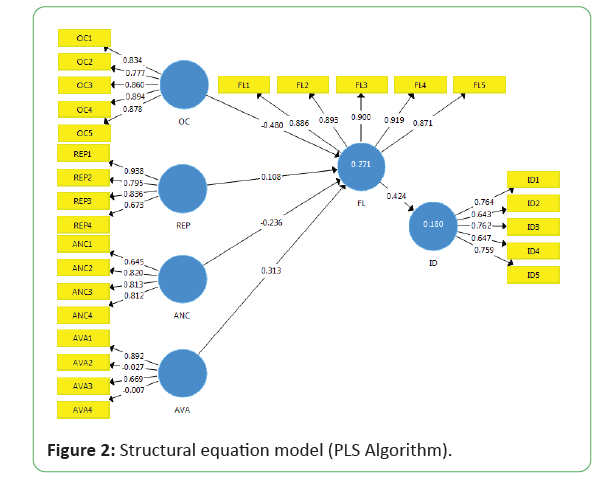

The questionnaire used in this research has been modified from previous studies. The questionnaire was adapted from various studies for measuring heuristic behavioral factors and their four dimensions; for example, the measurement of overconfidence was taken from, and the scale for representativeness was taken from [77,78]. Studies are considered to assess anchoring and availability [77]. Financial literacy is assessed using a question from study, and investment decision is assessed using a questionnaire from the studies (Figure 2) [78,79].

Figure 2: Structural equation model (PLS Algorithm).

Results

After managing the missing data, the data is analyzed using statistical analytic tools such as SMART-PLS. The relationship between the variables is investigated using SEM. SEM (Structural Equation Modeling) is a multivariate statistical technique that incorporates both latent and observed variables to evaluate structural theory [80]. Since it is a new generation technique, and the questionnaire was developed from various researches, SMART-PLS was used for study (Figure 2) [81].

Cronbach alpha

In the above Table 2, the value of Cronbach alpha shows the reliability and internal consistency between the items of the data, which must be more than 0.7, the excellent value of Cronbach alpha is from 0.8 to 1.0. The above values show that Cronbach alpha values are more than 0.7, so the data is sufficiently reliable and consistent internally

| Cronbach’s alpha | Composite reliability | Average variance extracted (AVE) | |

|---|---|---|---|

| Anchoring | 0.83 | 0.85 | 0.799 |

| Overconfidence | 0.90 | 0.92 | 0.722 |

| Representativeness | 0.89 | 0.88 | 0.849 |

| Availability | 0.78 | 0.80 | 0.76 |

| Financial literacy | 0.93 | 0.95 | 0.757 |

| Investment decision | 0.77 | 0.84 | 0.515 |

Table 2: Reliability and validity.

Composite reliability

Composite reliability is the alternative preferred in the case of Cronbach alpha; its value must exist from 0.6 to 1.0 [82]. For confirmatory research, the value of composite reliability more than 0.8 is considered acceptable. In the above cases, the composite reliability ranged above the threshold limit

The Average Variance Extracted (AVE)

The table's validity can also be measured through AVE (average variance extracted); its value must be more than 0.5 [82]. The values of all constructs age hierarchy, anchoring; availability, overconfidence, representativeness; financial literacy, and investment decision are more than 0.5, from 0.515 to 1.000

Correlation matrix and discriminant validity

For discriminant validity, AVE's square root must be high than the correlation constructs [83]. To measure the internal consistency, the values in the column of first must be high than its values in the diagonal, whereas in the above (Table 3). The values of age hierarchy, anchoring, availability, overconfidence, representativeness, financial literacy, and investment decision are high as compared to their diagonal values. It means data are discriminatory valid (Table 4)

| ANC | AVA | FL | ID | OC | REP | |

|---|---|---|---|---|---|---|

| ANC | 0.77 | |||||

| AVA | 0.40 | 0.55 | ||||

| FL | -0.11 | 0.16 | 0.89 | |||

| ID | -0.12 | 0.27 | 0.42 | 0.717 | ||

| OC | 0.15 | 0.16 | -0.43 | 0.009 | 0.850 | |

| REP | 0.65 | 0.21 | -0.12 | -0.002 | 0.311 | 0.81 |

Table 3: Correlation matrix and discriminant validity.

| R Square | Adjusted R square | |

|---|---|---|

| Financial literacy | 0.70 | 0.66 |

| Investment decision | 0.71 | 0.69 |

Table 4: Fitness of the model.

R-square

R square's value must be above 0.6 and near to 0.9 for the good fit model [84-100]. The values of financial literacy and investment decision are above 0.7, so the model is considered a good fit

Structural modeling analysis (SEM) through smart-pls

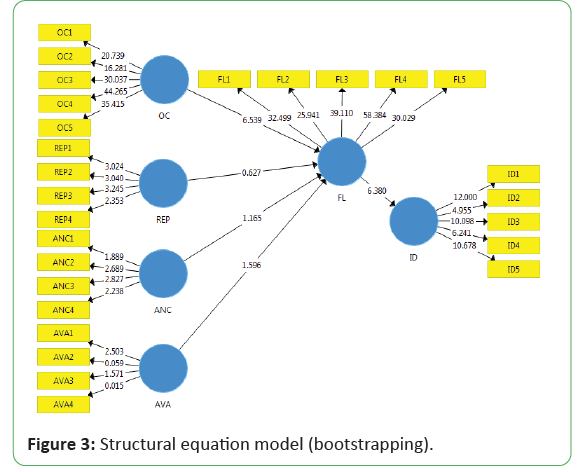

To run the SEM in the SAMRT-PLS, we have to go through the bootstrapping through calculations after drawing the model (Figure 3).

Figure 3: Structural equation model (bootstrapping).

The above Table 5 anchoring has an insignificant impact on financial literacy with 0.245. Thus H6 is rejected. Similarly, overconfidence has a significant positive relationship with financial literacy with a p-value 0.000, which means with the increase in overconfidence, the financial literacy increases, and thus H2 is accepted. Furthermore, the availability, representativeness has an insignificant impact on financial literacy with-value 0.11 and 0.53, which means H8 and H4 are rejected. Thus, with the increase in representativeness and availability bias has no link with financial literacy of women. Financial literacy has a significant relationship with an investment decision with p-0.000; thus, H13 is accepted

| Sample Mean (M) | T Statistics (|O/STDEV|) | P Values | |

|---|---|---|---|

| ANC -> FL | 0.202 | 1.165 | 0.245 |

| AVL -> FL | 0.196 | 1.596 | 0.111 |

| FL -> ID | 0.066 | 6.38 | 0.000 |

| OC -> FL | 0.073 | 6.53 | 0 |

| REP -> FL | 0.172 | 0.62 | 0.53 |

Table 5: Hypotheses testing through path coefficient.

The above Table 6 shows that anchoring has an insignificant negative impact, and representativeness has an insignificant positive relationship with the investment decision with p-0.27 and p-0.55, which rejects the H5 and H3. While the overconfidence has a significant negative effect, with the decrease in overconfidence bias, the investment decisions improve; thus, H1 is accepted, and availability has also significant positive impact with a p-value 0.04 Thus H7 is also accepted. Financial literacy played the partial mediating role between overconfidence; thus H9 is accepted and no mediation is seen in case of anchoring and representativeness thus H10 and H11. Full mediation is seen in case of availability heuristics thus H12 is accepted [100-110].

| Sample Mean (M) | Standard Deviation (STDEV) | T Statistics (|O/STDEV|) | P Values | |

|---|---|---|---|---|

| ANC-> ID | -0.076 | 0.09 | 1.085 | 0.27 |

| AVL -> ID | 0.098 | 0.09 | 2.46 | 0.04 |

| OC -> ID | -0.205 | 0.04 | 4.7 | 0.000 |

| REP -> ID | 0.044 | 0.07 | 0.59 | 0.55 |

Table 6: Indirect effects.

Discussion

In light of the findings, we propose that financial literacy plays a mediating role in the relationship between heuristic activity and women's investment decision-making. Financial literacy has an enlightening impact on investment decisions, according to [89]. This study emphasized the role of financial literacy in mediating the relationship between behavioral factors and investment decisions. The effect of overconfidence and the availability heuristic on investment decisions is partially mediated by financial literacy, according to this study. The mechanism of financial literacy as a mediator between heuristic action and investment decisions by women entrepreneurs was explored in this study. Second, it has aided in the awareness of the importance of financial literacy for female entrepreneurs in developing countries such as Pakistan, where women face unique challenges in making investment decisions. Finally, this research has helped in the growth of women's trust in making investment decisions in order to contribute economically and socially in Pakistan. Our findings revealed that while anchoring and representativeness are negligible, overconfidence and availability have a significant effect on women entrepreneurs' financial literacy mediating. Individual investors, whether male or female, demonstrate irrational behavior as compared to institutional investors (Farooq et al), making it equally important to empirically research women's investor behaviour [85]. Women who are financially literate are less biased in overconfidence and representativeness while making financial decisions. Women prefer a slow start but wait until it is profitable; they rarely leave early, even if their investment is losing money. Women entrepreneurs in Pakistan who are engaged in economic activities have the potential to alter world dynamics and contribute to poverty alleviation in volatile business environments [86,87]. Women entrepreneurs, according to the report, are long-term investors and risk-takers who rely on financial literacy for a successful investment career. They are unable to comprehend audits, correct accounting systems, investments, and fund raising due to their lack of financial literacy. While previous research has argued about the effect of behavioral influences on investment decisions, the above findings indicate that financial literacy is crucial in making sound decisions [87]. Cognitive errors can lead to unreasonable decisions and mislead the entire investment process if they are not discovered or exhausted in a timely manner. Financial literacy has proven to be useful in preventing cognitive errors. Despite the fact that there are many behavioral finance studies, scholars have been researching women's entrepreneurship for about 25 years, there are still many unanswered questions [88]. As a result, this is one of the first studies of Pakistani female investors' heuristic behavior in terms of financial literacy, filling a gap in the behavioral finance literature [111-115]. Empirical results also indicate that investors' financial expertise is often useful in obtaining accurate information about stock values, market research, patterns, and consumer moods, which assists entrepreneurs in making investment decisions and avoiding behavioral biases (Table 7).

| Hypotheses | Accepted/Rejected |

|---|---|

| H1-Overconfidence has a significant impact on investment decision | Accepted |

| H2-Overconfidence has a significant impact on financial literacy | Accepted |

| H3-Representativeness has a significant impact on investment decision | Rejected |

| H4- Representativeness has a significant impact on financial literacy | Rejected |

| H5-Anchoring has a significant impact on investment decision | Rejected |

| H6- Anchoring has a significant impact on financial literacy | Rejected |

| H7-Availability has a significant impact on investment decision | Accepted |

| H8- Availability has a significant impact on financial literacy | Rejected |

| H9-Financial literacy mediates the relationship between overconfidence and investment decision | Accepted |

| H10-Financial literacy mediates the relationship between representativeness and investment decision | Rejected |

| H11-Financial literacy mediates the relationship between anchoring and investment decision | Rejected |

| H12-Financial literacy mediates the relationship between availability and investment decision | Accepted |

| H13-Financial literacy has a significant impact on investment decision | Accepted |

Table 7: Accepted or rejected hypotheses.

Conclusion

This study examined the impact of heuristics behavioral factors on women entrepreneurs' investment decisions registered in Punjab, Pakistan. Without the proper knowledge of business and financial literacy, a woman cannot change her behavior regarding her investment decisions and the age hierarchy of a woman has a significant impact on the investment decision.

Implications, Limitations and Future Directions

Practically, this research would help government officials develop policies to alleviate poverty elimination programs by boosting entrepreneurship among women through business management awareness programs. Funds allocation system should also be improved regarding women entrepreneurship. Based on women's psychology regarding investment decisions, the government can plan women-related venture programs, loaning schemes, and tax reliefs. This could be possible through proper financial literacy regarding tax and audit training for the women entrepreneurs.

Only the women entrepreneurs from Punjab, Pakistan, are taken for study. Future researchers can be done by taking into account the other behavior factor's impact on women entrepreneurs. The comparative study could also be done by considering both male and female entrepreneurs. Future researchers can survey other women belonging to advanced economies if their decision-making is affected. It will also be a good idea to assess a comparative study between Asian and European women entrepreneurs; it will configure theoretical contributions and policy implications in the best way. Similarly, we relied on the cross-section data; future researchers are recommended a qualitative approach using interviews to avoid common method bias.

References

- Dang T, Phan T, Tran V, Tran T, Pham T (2019) The impact of accounting disclosures on individual investors’ decision making in Vietnam Stock Market. Manag Sci Lett 9(13): 2391-2402.

- Ghaeli MR (2019) The role of gender in corporate governance: A state-of-art review. Accounting 5(1): 31-34.

- Salim A (2015) Women Empowerment through Long Term Orientation with Special Reference to SHG, Kerala Region. Int J Sci Res 0-83.

- Sharma S (2018) Emerging Dimensions of Women Entrepreneurship: Developments & Obstructions. Economic Affairs 63(2).

- Kiss AN, Danis WM, Cavusgil ST (2012) International entrepreneurship research in emerging economies: A critical review and research agenda. J Bus Ventur 27(2): 266-290.

- Khan N, Iqbal N, Haider N (2015) Analysis on Corporate Social-Financial Performance Link. Int lett soc humanist sci 54: 16-20.

- Castellanza L (2020) Discipline, abjection, and poverty alleviation through entrepreneurship: A constitutive perspective J Bus Ventur

- Rashid S, Ratten V (2020) A dynamic capabilities approach for the survival of Pakistani family-owned business in the digital world. J Fam Bus Manag 10(4): 373-387.

- Roomi MA, Parrott G (2008) Barriers to development and progression of women entrepreneurs in Pakistan. J Entrep 17(1): 59-72.

- Shakeel M, Yaokuang L, Gohar A (2020). Identifying the Entrepreneurial Success Factors and the Performance of Women-Owned Businesses in Pakistan: The Moderating Role of National Culture. SAGE Open 10(2).

- Iqbal N, Rajput AA, Qadeer A (2011) HRD Practices in Banking Sector of Pakistan. J Manag Tech 46.

- Bouzekraoui H, Ferhane D (2017) An exploratory study of women's entrepreneurship in Morocco. J Entrepreneurship 2017: 2-19.

- Zeb A, Amin RU, Kakakhel SJ, Ihsan A (2020) Impact of Financial Resources on Women's Entrepreneurial Performance of Pakistan; Comparative Study of Registered and Non-Registered Women Entrepreneurs. City Univ res j 10(3): 376-394.

- Khattak MA, Ul-Ain Q, Iqbal N (2013) Impact of role ambiguity on job satisfaction, mediating role of job stress. International Journal of Academic Research in Accounting. Finance and Management Sciences 3(3): 28-39.

- Mohamad M, Kasuma J (2016) Identifying motivation factor involvement of Sarawak Malay women entrepreneur. Jurnal Ilmiah Manajemen dan Kewirausahaan 18(1): 54-59.

- Bhavani M (2020) A Study on Problems of Women Entrepreneurs at Mysore District, India. Our Heritage 68(1): 9183-9200.

- Khan S, Sohail M, Abdullah FA Fresh (2019) Perspective on Female Entrepreneurship: An Insight from Pakistan. Glob Soc Sci Rev 4(3): 318-325.

- Hasan SM (2020) Female Entrepreneurship: Do Urban Centers Ease Out the Challenge? An Analysis for Pakistan. Urb Stu Ent. 163-179.

- Sadaquat MB (2011) Employment situation of women in Pakistan. International Journal of social economics 3(2): 98-113.

- JM, Rastogi S (2020) Investment behavior of women entrepreneurs. Qualitative Research in Financial Markets 12(4): 485-504.

- Shah H, Saurabh P (2015) Women entrepreneurs in developing nations: Growth and replication strategies and their impact on poverty alleviation. Technol. Innov Manag Rev 5(8):34-51.

- Ahmad M (2020). Does underconfidence matter in short-term and long-term investment decisions?. Evidence from an emerging market. Manag Decis 12(4).

- Vanjikkodi T, Gayathri R (2019). Financial Literacy of Women Entrepreneurs.Indian Academic Researcher Association 7(24): 50-52

- Baporikar N, Akino S (2020) Financial Literacy Imperative for Success of Women Entrepreneurship. Int. J. Innov. Technol. Manag 11(3): 1-21.

- Yasin RFF, Mahmud MW, Diniyya AA (2020) Significance of Financial Literacy among Women Entrepreneur on Halal Business. Journal of Halal Industry & Services 3: 1-9.

- Smith TE, Richards KV, Shelton VM (2016). Mindfulness in financial literacy. J Hum Behav Soc Environ 26(2): 154-161.

- Richards KV, Thyer BA (2011) Does individual development account participation help the poor? A review. Res. Soc. Work Pract. 21(3): 348-362.

- Baporikar N, Akino S (2020) Financial Literacy Imperative for Success of Women Entrepreneurship. Int J Innov Technol Manag 11(3): 1-21.

- Goyal K, Kumar S (2021). Financial literacy: A systematic review and bibliometric analysis. Int J Consum Stud 45(1): 80-105.

- Ritter JR (2003) Investment banking and securities issuance. In Handbook of the Economics of Finance.1: 255-306.

- Tversky A, Kahneman D (1974) Judgment under uncertainty: Heuristics and biases. Science 185(4157): 1124-1131.

- Waweru N, Kalani VM (2008) Commercial banking crises in Kenya: Causes and remedies. Global Journal of Finance and Banking Issues 3(3): 23-43.

- Shah SZA, Ahmad M, Mahmood F (2018) Heuristic biases in investment decision-making and perceived market efficiency. Qualitative Research in Financial Markets 10(1): 85-110.

- Porto N, Xiao JJ (2016) Financial Literacy Overconfidence and Financial Advice Seeking. Journal of Financial Service Professionals 70(4).

- Durand R, Newby R, Tant K, Trepongkaruna S (2013) Overconfidence, overreaction and personality. Review of Behavioral Finance 5(2): 104-133.

- Xia T, Wang Z, Li K (2014) Financial literacy overconfidence and stock market participation. Soc Indic Res 119(3): 1233-1245.

- Ahmad M, Shah SZA (2020) Overconfidence heuristic-driven bias in investment decision-making and performance: mediating effects of risk perception and moderating effects of financial literacy. J Econ Finance Adm Sci 20

- Einhorn HJ, Hogarth RM (1981) Behavioral decision theory: Processes of judgement and choice. Annu Rev Psychol 19(1): 1-31.

- Kahneman D, Slovic SP, Slovic P, Tversky A (1981) Judgment under uncertainty: Heuristics and biases. Cambridge university press.

- Kahneman D, Tversky A (1972) Subjective probability: A judgment of representativeness. Cogn Psychol 3(3): 430-454.

- Novianggie V, Asandimitra N (2019) The Influence of Behavioral Bias, Cognitive Bias, and Emotional Bias on Investment Decision for College Students with Financial Literacy as the Moderating Variable. Int j acad res account financ manag sci 9(2): 92-107.

- Wilde TRWD, Velden TFS, Dreu, de CKW (2018). The anchoring-bias in groups. J Exp Soc Psychol 76: 116-126.

- Meub L, Proeger T, Bizer K (2013) Anchoring: A valid explanation for biased forecasts when rational predictions are easily accessible and well incentivized?

- Wilczek B (2016) Herd behaviour and path dependence in news markets: Towards an economic theory of scandal formation. J Interdiscip Econ 28(2): 137-167.

- Din SMU, Mehmood SK, Shahzad A, Ahmed I, Davidyants A, Abu-Rumman A (2020) The Impact of Behavioral Biases on Herding Behavior of Investors in Islamic Financial Products. Front Psychol 11.

- Peña VA, Gómez-Mejía A (2019) Effect of the anchoring and adjustment heuristic and optimism bias in stock market forecasts. Rev Finanz y Economic Policy 11(2): 389-409.

- Englich B, Mussweiler T, Strack F (2006) Playing dice with criminal sentences: The influence of irrelevant anchors on experts’ judicial decision making. Pers Soc Psychol Bull 32(2): 188-200.

- Sharpe S, Campbell SD (2007) Anchoring bias in consensus forecasts and its effect on market prices (No. 2007-12). Board of Governors of the Federal Reserve System (US).

- Esubalew AA, Raghurama A (2020). The mediating effect of entrepreneurs’ competency on the relationship between Bank finance and performance of micro, small, and medium enterprises (MSMEs). Eur res manag bus Econ 26(2): 87-95.

- Kaustia M, Alho E, Puttonen V (2008) How much does expertise reduce behavioral biases? The case of anchoring effects in stock return estimates. Financial Management 37(3): 391-412.

- Abreu,M., Mendes, V (2010). Financial literacy and portfolio diversification. Quant Finance 10(5):515-528.

- Pompian MM (2011) Behavioral finance and wealth management: How to build investment strategies that account for investor biases. John Wiley & Sons.

- Pompian MM (2011) Behavioral finance and wealth management: How to build investment strategies that account for investor biases. John Wiley & Sons.

- Hayibor S, Wasieleski DM (2009). Effects of the use of the availability heuristic on ethical decision-making in organizations. J Bus Ethics 84(1): 151-165.

- Kliger D, Kudryavtsev A (2010) The availability heuristic and investors' reaction to company-specific events. J Behav Finance 11(1): 50-65.

- Anwar M, Khan SZ, Rehman AU (2017) Financial Literacy, Behavioral Biases and Investor’s Portfolio Diversification: Empirical Study of an Emerging Stock Market. J financ Econ 2(2): 144-163.

- Barber BM, Odean T (2008) All that glitters: The effect of attention and news on the buying behavior of individual and institutional investors. Rev Financ Stud 21(2): 785-818.

- Tuffour JK, Amoako AA, Amartey EO (2020) Assessing the effect of financial literacy among managers on the performance of small-scale enterprises. Glob Bus Rev 21(2): 1-18.

- Iqbal N, Iqbal S (2015) Investor Behavior & Fundamental Analysis: A Case of Karachi Stock Exchange Investor’s. Int lett soc humanist sci 59: 85-88.

- Chu Z, Wang Z, Xiao JJ, Zhang W (2017) Financial literacy, portfolio choice and financial well-being. Soc Indic Res 132(2): 799-820.

- Huhmann BA (2017) Literacy matters in marketing. Int J Bank Mark 35(5): 750-760

- Rekik YM, Boujelbene Y (2013) Determinants of individual investors’ behaviors: Evidence from Tunisian stock market. Journal of Business and Management 8(2): 109-119.

- Baker HK, Kumar S, Goyal N, Gaur V (2019) How financial literacy and demographic variables relate to behavioral biases. Managerial Finance 45(1): 124-146.

- Sheeraz M, Khattak AK, Mahmood S, Iqbal N (2016) Mediation of attitude toward brand on the relationship between service brand credibility and purchase intentions. J Commer Soc Sci 10(1): 149-163.

- Altman M (2012) Implications of behavioural economics for financial literacy and public policy. Int J Soc Econ 41(5): 677-690.

- Lusardi A, Mitchell OS (2011) Financial literacy around the world: an overview. National Bureau of Economic Research Working Paper Series.

- Huston SJ (2010) Measuring financial literacy. J Consum Aff 44(2): 296-316.

- Atkinson A, Messy FA (2012) Measuring financial literacy: Results of the OECD/International Network on Financial Education (INFE) pilot study

- Awais M, Laber MF, Rasheed N, Khursheed A (2016) Impact of financial literacy and investment experience on risk tolerance and investment decisions: empirical evidence from Pakistan. International Journal of Economics and Financial Issues 6(1): 73-79

- Eniola AA, Entebang H (2017) SME managers and financial literacy. Glob. Bus. Rev. 18(3): 559-576.

- Ricciardi V, Simon HK (2000) What is behavioral finance?. Business, Education & Technology Journal 2(2): 1-9.

- De Bondt WP (1993). Betting on trends: Intuitive forecasts of financial risk and return. Int J Forecast 9(3): 355-371.

- Raut RK, Das N, Mishra R (2020) Behaviour of individual investors in stock market trading: Evidence from India. Glob Bus Rev 21(3):818-833.

- Atkinson A, Messy FA (2012) Measuring financial literacy: Results of the OECD/International Network on Financial Education (INFE) pilot study.

- Christopher IF (2011) Impact of microfinance on small and medium-sized enterprises in Nigeria. In Proceedings of the 7th international conference on innovation & management 1864-1871.

- Ruane JM (2005) Essentials of Research Methods-A guide to social science research. Malden MA: Blackwell Publishing 26(1): 15:55

- Ruane JM (2005) Essentials of Research Methods-A guide to social science research. Malden MA: Blackwell Publishing. 26(1): 15:55

- Babajide AA, Adetiloye KA (2012) Investors' behavioral biases and the security market: An empirical study of the Nigerian security market. Accounting and Finance Research 1(1): 219-229.

- Waweru NM, Munyoki E, Uliana E (2008) The effects of behavioral factors in investment decision-making: a survey of institutional investors operating at the Nairobi Stock Exchange. Int J Bus Emerg Mark 1(1): 24-41.

- Mandell L, Klein LS (2007) Motivation and financial literacy. Financial services review 16(2):105-116.

- De Carvalho J, Chima FO (2014) Applications of structural equation modeling in social sciences research. Am Int J Contemp Res 4(1): 6-11.

- Ramayah TB, Forte D (2018) Financial literacy in Brazil–do knowledge and self-confidence relate with behavior?. RAUSP Management Journal 54(1): 77-95.

- Chin WW (1998) The partial least squares approach to structural equation modeling. Modern methods for business research 295(2): 295-336.

- Davidson R, MacKinnon JG (2008) Bootstrap inference in a linear equation estimated by instrumental variables. Econom J 11(3): 443-477

- Abdin SZU, Farooq O, Sultana N, Farooq M (2017) The impact of heuristics on investment decision and performance: Exploring multiple mediation mechanisms. Res Int Bus Finance 42: 674-688.

- Chin WW (2010) How to write up and report PLS analyses. In Handbook of partial least squares

- Castellanza L (2020) Discipline, abjection, and poverty alleviation through entrepreneurship: A constitutive perspective. J Bus Ventur.

- Chaudhary AK (2013) Impact of behavioral finance in investment decisions and strategies–a fresh approach. Int. J. Manag. Bus. Res. 2(2): 85-92.

- Carter N, Brush C., Greene P, Gatewood E, Hart M (2003) Women entrepreneurs who break through to equity financing: the influence of human, social and financial capital. Int J Entrepreneurship 5(1):1-28.

- Agarwal S, Driscoll JC, Gabaix X, Laibson D (2009) What is the age of reason?. Dementia 10(2): 51-117.

- Al Tamimi HAH. (2009) Financial literacy and investment decisions of UAE investors. J Risk Finance 10(5): 500-516

- Awais M, Laber MF, Rasheed N, Khursheed A (2016) Impact of financial literacy and investment experience on risk tolerance and investment decisions: empirical evidence from Pakistan. IJEFI 6(1): 73-79

- Baker HK, Kumar S, Goyal N, Gaur V (2019) How financial literacy and demographic variables relate to behavioral biases. Managerial Finance.

- Bhavani M (2017). A Study on Problems of Women Entrepreneurs at Mysore District, India. Our Heritage 68(1): 9183-9200.

- Chaudhary AK (2013) Impact of behavioral finance in investment decisions and strategies–a fresh approach. Int J Mgmt Res & Bus Strat 2(2): 85-92.

- Chin WW (2010) How to write up and report PLS analyses. In Handbook of partial least squares: 655-690

- Babajide AA, Adetiloye KA (2012) Investors' behavioral biases and the security market: An empirical study of the Nigerian security market. Account. Finance 1(1): 219-229.

- Bouzekraoui H, Ferhane D (2017) An exploratory study of women's entrepreneurship in Morocco. Journal of Entrepreneurship: Research & Practice 2017: 2-19.

- Carter N, Brush C, Greene P, Gatewood E, Hart M (2003) Women entrepreneurs who break through to equity financing: the influence of human, social and financial capital. Venture Capital: an international journal of entrepreneurial finance 5(1): 1-28.

- De Carvalho J, Chima FO (2014) Applications of structural equation modeling in social sciences research. Am Int J Contemp Res 4(1): 6-11.

- Iqbal N, Iqbal S (2018) English-Impact of Islamic Events on Pakistan Stock Exchange (Kse-100) Returns. The Scho-Islam Aca Res J 4(2): 173-189.

- Hair JF, Gabriel M, Patel V (2014) AMOS covariance-based structural equation modeling (CB-SEM): Guidelines on its application as a marketing research tool. Braz J Market, 13(2): 44-55.

- Iqbal N, Ahmad N, Ateeq M, Javaid K (2013) Role of Innovation on Organizational Growth: Evidences from Pakistan. Arabian Journal of Business and Management Review (Oman Chapter) 3(4): 20-30.

- Iqbal N, Rajput AA, Qadeer A (2011) HRD Practices in Banking Sector of Pakistan. J Manag Tech 46.

- Iqbal N, Ahmad N, Majid M, Nadeem M, Javed K et al (2013) Role of employee motivation on employee’s commitment in the context of banking sector of DG KHAN, Pakistan. J Hum Resour Manag 1(1): 1-8.

- Iqbal S, Iqbal N (2015) Financial reporting regime & financial statements antecedents banking sector case of Pakistan. International Letters of Social and Humanistic Sciences 59: 126-130.

- Kautonen T (2008) Understanding the older entrepreneur: Comparing third age and prime age entrepreneurs in Finland. International Journal of Business Science & Applied Management 3(3): 3-13.

- Li XX, Wang LX, Zhang J, Liu YX, Zhang H, et al (2014) Exploration of ecological factors related to the spatial heterogeneity of tuberculosis prevalence in PR China. Glob Health Action 7(1): 23620.

- Lusardi A, Mitchell OS (2007) Baby boomer retirement security: The roles of planning, financial literacy, and housing wealth. J Monet Econ 54(1): 205-224.

- Salim, A (2015) Women Empowerment through Long Term Orientation with Special Reference to SHG, Kerala Region. Int J Sci Res 0-83.

- Lusardi A, Mitchell OS (2009) Financial literacy: Evidence and implications for financial education. Trends and issues 1-10.

- Reilly FK, Brown KC (2011) Investment Analysis and Portfolio Management. Cengage Learning.

- Lusardi A, Mitchell OS, Curto V (2009) Financial literacy and financial sophistication among older Americans. National Bureau of Economic Research.

- Shastri RK, Sinha A (2010). The socio-cultural and economic effect on the development of women entrepreneurs (with special reference to India). Asian J Bus Manag 2(2): 30-34.

- Talpsepp T (2013) Does gender and age affect investor performance and the disposition effect? Research in Economics and Business: Central and Eastern Europe 2(1).

Open Access Journals

- Aquaculture & Veterinary Science

- Chemistry & Chemical Sciences

- Clinical Sciences

- Engineering

- General Science

- Genetics & Molecular Biology

- Health Care & Nursing

- Immunology & Microbiology

- Materials Science

- Mathematics & Physics

- Medical Sciences

- Neurology & Psychiatry

- Oncology & Cancer Science

- Pharmaceutical Sciences