Keywords

Forex trading data; Forex data experiments; Forex data analysis; Forex

data visualization

Introduction

When planning a forex trading system, a trader needs to carefully

design the system and extensively test it. Besides the help of

some technical indicators and fundamental analysis [1,2], a

trading system needs to set many risk management parameters,

such as stop loss and take profit [3]. These parameters play an

important rule to determine the trader’s target profit and also

limit the loss risk of each open trade.

To investigate the ideal level for risk management parameters

and the trading system, this research tries to find the answer

to those questions. Some experiments are conducted in the H1

timeframe, which updates the price hourly. Two main currency

pairs with different time ranges are used in this paper: EUR/USD

(1 year) and USD/JPY (20 years). The experiments use the dataset

from Kaggle, a website that provides many kinds of datasets for

machine learning and data scientists [4]. Some data visualization

techniques are used to represent the result of these data using

Weka. Weka is open source software that provides many machine

learning techniques and data visualization tools [5].

Methodology and Analysis

Forex trading

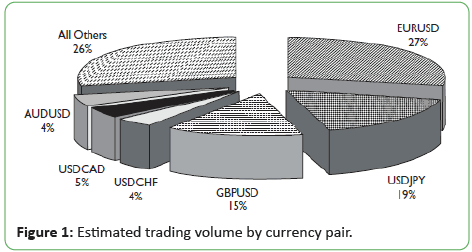

Forex (foreign exchange) is a global marketplace where the

banks, corporations, investors, and individual traders exchange

foreign currencies for a variety of reasons. The fluctuations

of these currencies are the target for traders for making some profit. But at the same time, a trader risks their account when

the market moves against his open position. The currencies are

traded in pairs. The four major currency pairs are EUR/USD, USD/

JPY, GBP/USD, and USD/CHF. Figure 1 shows the approximate

volume breakdown per currency pair [6].

The forex market works 24 hours a day, 5 days a week. Table 1 shows the opening and closing times [6].

| Time zone |

New York |

GMT |

| Tokyo Open |

7:00 p.m. |

00:00 |

| Tokyo Close |

4:00 a.m. |

09:00 |

| London Open |

3:00 a.m. |

08:00 |

| London Close |

12:00 p.m. |

17:00 |

| New York Open |

8:00 a.m. |

13:00 |

| New York Close |

5:00 p.m. |

22:00 |

Table 1: Global Trading hour schedule.

Figure 1: Estimated trading volume by currency pair.

Forex risk management

When a trader opens a position in the forex market, two actions

can be taken: buy or sell. If the trader thinks that the price will go

upward, he is supposed to open a buy position. On the contrary,

if the trader considers that the price will go downward, he is

supposed to open a sell position. After a trader chooses one

of that action, but unluckily the market moves against its open

position, the trader will lose. In this case, he has to protect his

account by limiting the loss he’s suffered. There are many types of

risk management strategies [3]. Some parameters that can be set

to limit the loss of any open trade are stop loss and target profit.

In this paper, some experiments are conducted to investigate the

ideal level to set these parameters.

Data preparation and mining

This research uses past forex data that is gained from Kaggle, a

website that provides many kinds of datasets for machine learning

and data scientists [4]. We choose the H1 timeframe of the two

top biggest volume currencies traded in the global market: EUR/

USD & USD/JPY [6]. This raw data is then cleaned, transformed,

and represented in some visualization charts by using Weka.

Weka is an open-source data mining and visualization framework.

Weka was developed at the University of Waikato, New Zealand. Figure 2 shows the user interface of Weka. This paper uses Weka

as a tool for data visualization and mining.

Figure 2: Weka interface.

Experiment Setup and Result

Experiments are conducted to the top two biggest volume traded

currency pairs: EUR/USD and USD/JPY. The H1 timeframe for

1 year is used for all the experiments. As mention before, the

datasets that are used in these experiments are from Kaggle.

com [3], a website that provides many kinds of datasets for

machine learning and data science purposes. These datasets use

pip (price in percentage), which is the smallest value by which a

currency may fluctuate in the forex market [5]. The goals of these

experiments are explained in the following sections.

Experiment with information gain

The goal of this experiment is to sort the most important

attributes to the price change above 10 pips. Table 2 shows the

experimental result.

| No. |

Attribute |

Information gain |

| 1 |

Date |

0.1438 |

| 2 |

Volume |

0.125 |

| 3 |

Low |

0.0661 |

| 4 |

Close |

0.0661 |

| 5 |

High |

0.0657 |

| 6 |

Open |

0.0656 |

| 7 |

Hour |

0.0599 |

Table 2: Information gain experiment.

Two top attributes are date and volume. This shows that in some

certain times, the forex market is trending (the price change

above 10 pips) and the number of volumes influences this trend.

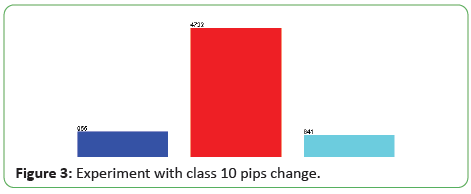

Experiment with 10 pips of currency fluctuation

Based on the first experiment, the dataset is categorized based

on the pip change that shows whether the market is on the

condition of trending or sideways. So in this experiment, a new

attribute, Class 10 Pip Change, was added based on the open

price of the next candle minus the close price of the previous

candle. This attribute has three possibilities of value:

• -10pips: the price decrease above 10 pips

• ranging: the price change below 10 pips

• +10pips: the price increase above 10 pips

Table 3 and Figure 3 show the result of this experiment.

| No. |

Attribute value for class 10 pip change |

Number of records |

| 1 |

-10pips |

955 |

| 2 |

ranging |

4722 |

| 3 |

+10pips |

841 |

| Total |

6518 |

Table 3: Experiment with class 10 pips change.

Figure 3: Experiment with class 10 pips change.

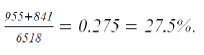

From the data distribution, it can be concluded that most of

the time EUR/USD is fluctuated below 10 pips, which shows the

condition of sideways or ranging. From 6,518 different records,

4,722 records of it (72%) is the change below 10 pips. This data

can be used to determine the algorithm of how to trade the forex

currency pair. The algorithm must be dealt with ranging market.

From this experiment, the trader can decide how many percent

of winning chance if he set the forex parameters such as stop loss

or target profit level at a certain position.The chance of uptrend

or downtrend can be calculated as

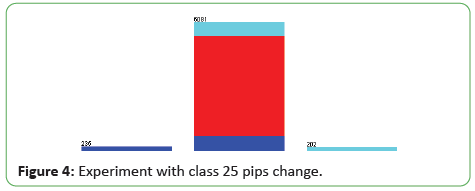

Experiment with 25 pips of currency fluctuation

Similar with the previous experiment, the dataset is categorized based on the 25 pip change that shows whether the market is on

the condition of trending or sideways. So in this experiment, a

new attribute, Class 25 Pip Change, was added based on the open

price of the next candle minus the close price of the previous

candle. This attribute has three possibilities of value:

• -25pips: the price decrease above 25 pips

• ranging: the price change below 25 pips

• +25pips: the price increase above 25 pips

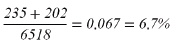

Table 4 and Figure 4 show the result of this experiment. From

the data distribution, it can be concluded that most of the time

EUR/USD fluctuates below 25 pips, which shows the condition of

sideways or ranging. From 6,518 different records, 6,081 records

of it (93%) is the change below 25 pips. This data can be used

to determine the algorithm of how to trade the forex currency

pair. The algorithm must be dealt with the ranging market. From

this experiment, the trader can decide how many percent of

winning chance if he set the forex parameters such as stop loss or

target profit level at a certain position. The chance of uptrend or

downtrend can be calculated as

| No. |

Attribute value for class 25 pip change |

Number of records |

| 1 |

-25pips |

235 |

| 2 |

ranging |

6081 |

| 3 |

+25pips |

202 |

| Total |

6518 |

Table 4: Experiment with class 25 pips change.

Figure 4: Experiment with class 25 pips change.

Experiment comparison of uptrend to downtrend EUR/USD

The goal of this experiment is to know the comparison of the up

prices to the down prices in EUR/USD pairs. A new attribute Class

Price Up was added in this experiment, with two possibilities of

value: TRUE or FALSE. TRUE means the next close price is higher

than the previous close price. FALSE means the contrary.

Table 5 and Figure 5 show the result of this experiment.

| No. |

Attribute value for class price up |

Number of records |

| 1 |

FALSE |

3362 |

| 2 |

TRUE |

3156 |

| Total |

6518 |

Table 5: Experiment with class 25 pips change.

This experiment shows that the number of up prices more or less

equals the number of down prices. From this experiment, the

trader has a 50:50 percent chance to buy or sell decisions.

Figure 5: Experiment with class price up.

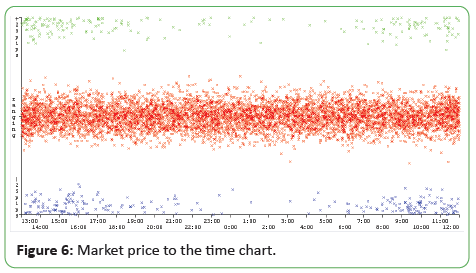

Experiment time of EUR/USD trending market

The goal of this experiment is to know the tendency of the time

when the EUR/USD is trending during a day. The price of each

transaction to the time of a day is plotted in the chart below

(Figure 6).

Figure 6: Market price to the time chart.

The X-axis shows the time of the days and the Y-axis shows the

attribute value of Class 25 Pips Change: -25pips, ranging, or

+25pips. The red dots show the ranging market that happens

most of the time of any day. The green dots represent the up

trending market that moves above 25 pips. From the chart, it

can be seen that most of the trending market happened during

office hours (7a.m. to 5 p.m.). Outside that time, the trend rarely

happened.

From this experiment, if the trader’s used the trending algorithm,

it would be better to apply it during office hours. On the other

hand, if the trader uses an algorithm that can be dealt with

ranging markets, it can be applied most of the time of the day.

The trader can set the forex parameters, such as stop loss and

take profit below 25 pips to gain more profit or reduce the risks.

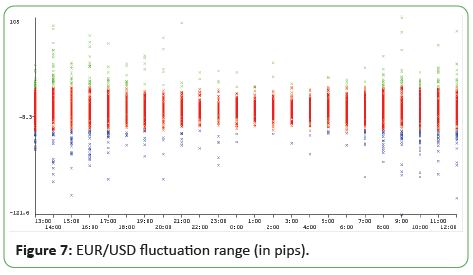

Figure 7 shows the pip change range to time in the EUR/USD forex

market. From this figure, it can be seen that the most trending

market happened at about 14:00-15.00. If some of this data is

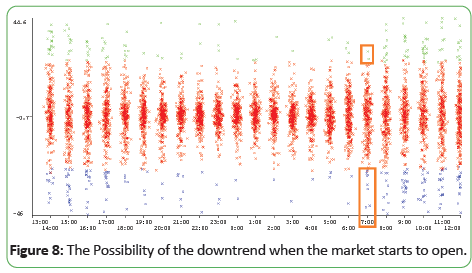

selected (Figure 8), it can be seen that when the market starts

to open, the possibility of the downtrend is more often than the

uptrend.

Figure 7: EUR/USD fluctuation range (in pips).

Figure 8: The Possibility of the downtrend when the market starts to open.

Experiment time of EUR/USD trending market

The goal of this experiment is to know the characteristics of

another major currency pair in forex: USD/JPY. In this experiment,

we used a large dataset (H1 timeframe, for 20 years from 1999 to

2019) that consists of 128,800 records of transactions. This data

is categorized into groups of attribute Class 10 Pip Change:

• -10pips: the price decrease above 10 pips

• ranging: the price change below 10 pips

• +10pips: the price increase above 10 pips

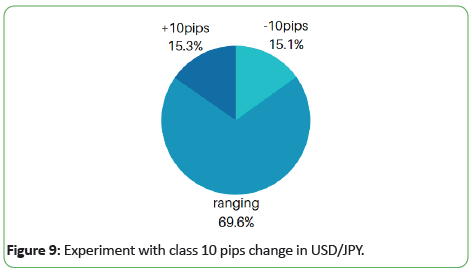

Table 6 and Figure 9 show the result of this experiment. From the

data distribution, 69.6% of all the transactions fluctuated below

10 pips, which shows the condition of sideways or ranging. While

the other 15.3% and 15.1% each is the up and down trend (more

than 10 pip change). This shows that the opportunity to buy and

sale is comparable for each new open position.

| No. |

Attribute value for class 10 pip change |

Number of records |

| 1 |

-10pips |

19, 494 |

| 2 |

ranging |

89, 618 |

| 3 |

+10pips |

19, 688 |

| Total |

128, 800 |

Table 6: Experiment with class 10 pips change.

Figure 9: Experiment with class 10 pips change in USD/JPY.

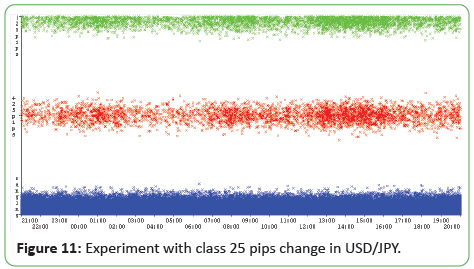

Experiment with 25 Pips of currency fluctuation

Similar to the previous experiment, the dataset is categorized

based on the 25 pip change that shows whether the market is

on the condition of trending or sideways. So in this experiment, a

new attribute, Class 25 Pip Change, was added based on the open

price of the next candle minus the close price of the previous

candle. This attribute has three possibilities of value:

• -25pips: the price decrease above 25 pips

• ranging: the price change below 25 pips

• +25pips: the price increase above 25 pips

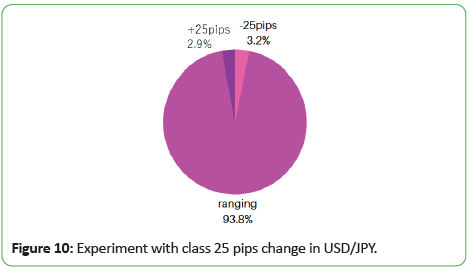

Table 7 and Figure 10 show the result of this experiment. From

the data distribution, it can be seen that 93.8% of all the USD/

JPY transaction records fluctuated below 25 pips, which shows

the condition of sideways or ranging. This data can be used to

determine the forex risk management parameter such as stop

loss and take profit. If they are set above 25 pips, the winning

possibility is below 6.1%. It also can be concluded that if the

trader uses an algorithm or strategy that can work when the

market is ranging/ sideways, the profit gain will be more bigger

than an algorithm that only works in a trending market. This is

because 93.8% of all the last 20 years transactions are ranging

below 25 pips.

| No. |

Attribute value for class 25 pip change |

Number of records |

| 1 |

-25pips |

4,125 |

| 2 |

ranging |

120,865 |

| 3 |

+25pips |

3,810 |

| Total |

128,800 |

Table 7: Experiment with class 25 pips change.

Figure 10: Experiment with class 25 pips change in USD/JPY.

Experiment with USD/JPY trending time

The goal of this experiment is to know the best time to trend USD/

JPY if a trader uses an algorithm that counts on-trend. Figure 11 shows the transactions plotted against time. The red dots show

the upward trend above 25 pips. The green dots show downward

trends of more than 25 pips. The blue dots represent the ranging

market. The trend not only happened during the office hours (7

a.m-5 p.m.) but also during midnights (11 p.m-3 a.m.).

Figure 11: Experiment with class 25 pips change in USD/JPY.

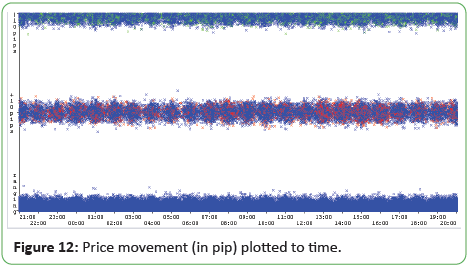

If we decrease the threshold to 10 pips, the chart will look like Figure 12. This data can be used to determine the level of stop

loss and take profit. Most of the time, the market fluctuates

between 10 pips to +10 pips.

Figure 12: Price movement (in pip) plotted to time.

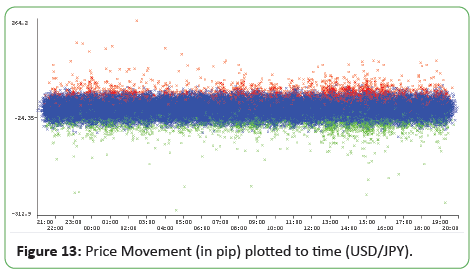

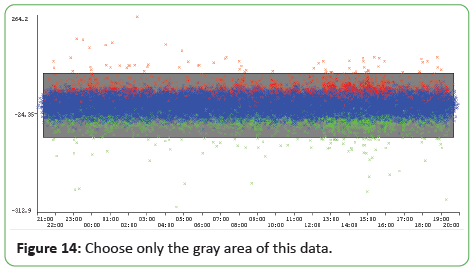

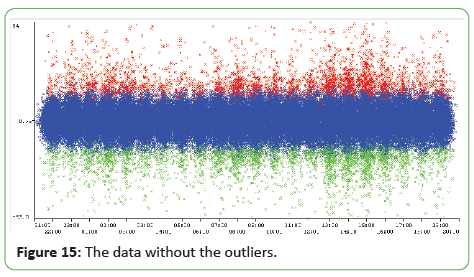

Figure 13 shows the pip change plotted to the time of a day.

From this plot, it can be seen that most of the trending market

happened at about 1 p.m. to 4 p.m. If we ignore the outliers of Figure 13 (Figure 14), we get the chart that is shown in Figure

15. The red dots show the upward trend above 25 pips, while the

green dots show the downward trend.

Figure 13: Price Movement (in pip) plotted to time (USD/JPY).

Figure 14: Choose only the gray area of this data.

Figure 15: The data without the outliers.

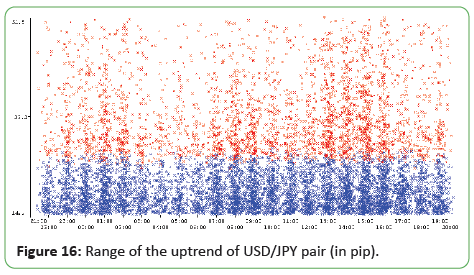

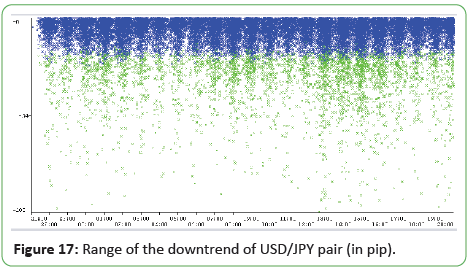

Figure 16 shows the uptrend fluctuation range and Figure 17 shows the downtrend fluctuation range (both in pip).

Figure 16: Range of the uptrend of USD/JPY pair (in pip).

Figure 17: Range of the downtrend of USD/JPY pair (in pip).

Conclusion

From the experiments, it can be concluded that most of the time,

the forex market is ranging below 10 pips. This can be used to

determine how a trading algorithm works. A forex trading robot

that can deal with ranging markets is preferable than the one

which only waits for the trending market. Most of the market

trends happened during office hours (7 a.m. to 5 p.m.) for EUR/

USD, but almost all the time for USD/JPY. The possibilities of

winning between buy and sell actions are comparable for both of

the major currencies pairs.

Acknowledgements

The authors would like to thank LPPM Parahyangan Catholic

University for the research grant and the Department of

Informatics Parahyangan Catholic University which supports the

research.

References

- Abednego L, Nugraheni CE (2015) Development of Forex Robot in Meta Trader 4. Prosiding International Congress on Engineering and Information, 2015.

- Abednego L, Nugraheni CE, Rinaldy I (2018) Forex trading robot with technical and fundamental analysis. J Comput 13: 1089-1097.

- Abednego L, Nugraheni CE (2018) Development of Forex Trading Robot with Money Management. Makalah dipresentasikan pada Asia Pacific Conference on Engineering and Applied Sciences-Higher Education, Sydney, Australia, 2018.

- Jimenez DF (2020) Forex currencies M1, M5, M15, M30, H1, H4, D1. Notebooks-www. Kaggle. com, 2020.

- Witten IH, Frank E, Hall M, Pal CJ (2016) Data Mining Practical Machine Learning Tools and Techniques. Morgan Kaufmann. Fourth Edition, 2016.

- Norris J, Bell T, Gaskill AI (2010) Mastering the Currency Market: Forex Strategies for High- and Low-Volatility Markets. McGraw-Hill Education, 2010.